The pressure on the global economy imposed by the measures to curb the COVID-19 pandemic threatens to erode whatever confidence the world still has in the U.S. dollar as a viable reserve currency. A shortfall in U.S. domestic savings, dropping to 1.4 percent of national income, brought on by the drawn-out shutdowns and structural changes to the ways of doing business, such as the phasing out of brick-and-mortar business establishments and the substitution of human labor with robotics, may be the canary in the coal mine of the upcoming economic paradigm shift.

Among the visible signs that a global monetary reset is in the offing is the state of currency speculation markets, which are progressively moving away from the dollar as illustrated by the $1.5 billion slash in short positions in the previous week, the largest in six weeks. A more inconspicuous red flag might be the decreasing power of the U.S. Federal Reserve to affect markets as it has over its relatively short existence with a mere word here or the moving of an interest rate point there.

Just five days ago, Fed chair Jerome Powell declared in a press conference that the U.S. banking system was “so much better capitalized, so much stronger, better aware of its risks, better at managing its risks, [and] more highly liquid…”, that it represented a “source of strength” in this environment of widespread economic pain. In former years, just these words from the head of the U.S. central bank would have been enough to shore up any misgivings by market participants. But exactly the opposite occurred.

A day after Powell’s remarks, “every major Wall Street bank tanked.” Citigroup, Bank of America, and JP Morgan Chase all lost 13.37 percent, 10.04 percent, and 8.34 percent respectively amid a broader market decline that recorded a 5.89 percent drop in the S&P 500. The reason Powell’s words failed to have an effect can be traced to the underlying reality which is revealed by the $6.23 trillion in emergency repo loans that these “highly liquid” banks have received over the course of a few months.

Trumpian Chaos

Trump’s man at the Treasury Steve Mnuchin, also continues to offer only election-year rhetoric, playing down the severity of the current crisis while the Fed rolls out the same bailout programs it used during the 2008 financial meltdown and has even added new ones, like the Main Street Loan Facility and the yet-to-be activated Municipal Liquidity Facility to support lending to city, state, and county governments.

The long-running deficit, last reported to be $498.4 billion, held by the U.S.’ current account, facilitated by the dollar’s reserve currency status, is running head-on into “exploding government budget deficits” in the middle of a global shutdown, which could drive domestic savings far deeper into negative territory, spelling doom for the “greenback.”

This is being exacerbated and, in real ways, driven by the Trump administration, which has shown a consistent trend towards isolationism and protectionist economic policies. From the border wall rhetoric to trade wars, Trump is effectively setting up the implosion of the dollar and couching it as pseudo nationalistic populism.

The President’s base is being led down the primrose path with empty promises of a revitalized American industrial Valhalla as the virtual tentacles of an automated and digitized economy with little use for their labor encircles us. In addition, the ongoing process of a China decoupling, an integral part of the petrodollar/reserve currency paradigm, will likely be the bookend for the dollar era should they decide to flood America with its own worthless money.

A Short Exercise

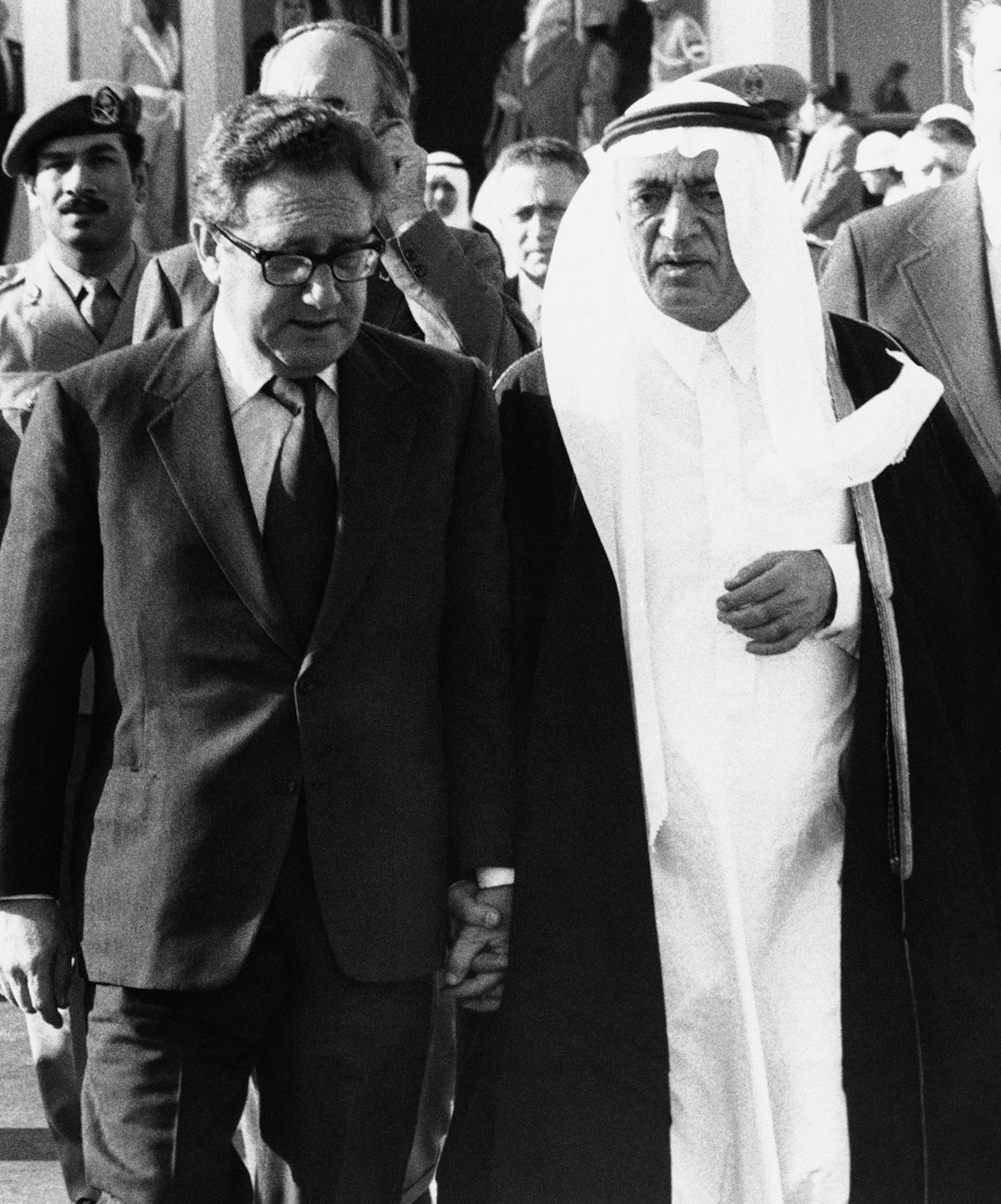

When Henry Kissinger made a deal with the Saudis to only accept dollars for their oil in exchange for a captive world market, the petrodollar was born and United States’ currency became the world’s de facto reserve currency. The system has been in place since the 1970s and has been enforced by market mechanisms, economic sanctions, and at the point of a gun. It substituted an older, semi-global financial order based on gold, destroyed deliberately over several decades starting with the Great Depression and unfolding right up to the end of World War II.

The world’s financial order would, henceforth, be directly and indirectly tied to the single most important natural resource of the twentieth century and the strongest military power on earth, which had, since the end of the war, morphed into what Eisenhower had presciently warned about just a few years removed from the end of that conflict.

Kissinger, left, holds hands with Saudi Foreign Minister Omar Saqqaf prior to his departure from Riyadh, Nov. 9, 1973. Harry Koundakjian | AP

The Military Industrial Complex had already been gestating during the war itself, but when the U.S. dollar became the coin of the realm, its influence over world affairs grew exponentially and gave the American political establishment leverage to affect the fate of other nations to an unprecedented degree, as well as the power to its financial institutions to mold capital markets to their whim.

As we near the 50-year milestone of this crucial shift in the global balance of power, its usefulness has begun to wane and a new system, virtually untethered from any fungible commodity or physical proxy, is being introduced by the very power structure it helped create. Confident in its grip over the mechanisms of global commerce in both physical goods and information, the dollar is being retired in favor of a digital currency system – an exercise that requires sacrificing the tightly-managed reputation of the world’s only superpower.

Losing Face

The mass civil disobedience now occurring in the streets of every major city of the United States also points in the direction of an inevitable crash of the dollar. It is yet another symptom of America’s precipitous fall from the perch as the world’s police. The domestic crisis now unfolding mirrors the diminishing prestige of the United States around the world.

Recent actions by the Trump administration against the International Criminal Court (ICC) and the Court’s response underscores the reality of what is on the horizon. After the ICC initiated an investigation into U.S. actions in Afghanistan, Trump issued sanctions and visa restrictions against the ICC citing threats to “U.S. sovereignty“.

The Court issued an official statement denouncing the measures as an “attempt to interfere with the rule of law and the Court’s judicial proceedings”, and publicly calling out the U.S. government for effectively attacking “the interests of victims of atrocity crimes, for many of whom the Court represents the last hope for justice.”

Given the unprecedented nature of both the domestic and international conflicts now afflicting America, as well as the immediate economic stress brought on by the forced shutdowns and accumulated decades of debt, a severe crash could mark the end of the petrodollar and, consequently, the end of global American hegemony before the end of the first half of the twenty-first century.

Feature photo | Demonstrators set fire to an American flag as they protest the murder of George Floyd, May 31, 2020, near the White House in Washington. Alex Brandon | AP

Raul Diego is a MintPress News Staff Writer, independent photojournalist, researcher, writer and documentary filmmaker.

The post American Exceptionalism Is on the Ropes and the End of the Petrodollar Is Nigh appeared first on MintPress News.