BEIJING – The United States’ ongoing attempts to wage a trade war on China will likely fail in terms of scuttling the growing East Asian economy’s hopes to improve its manufacturing base, yet many fear that the ongoing trade war between the two will derail world economic growth and ultimately harm all parties involved.

Such has been the conclusion of global commentators who watched this week as global share prices hit a slump Friday, marking their worst week in about six months.

The poor stock performances in both Asia and Europe come as a result of a failure by Beijing and Washington to resolve their trade dispute, with President Donald Trump instead vowing to impose new tariffs on another $200 billion in Chinese imports and China, in turn, vowing a tough response.

Speaking to reporters Thursday, Commerce Ministry spokesman Gao Feng reiterated Beijing’s resolve to help companies operating in China weather the storm resulting from any new tariffs:

If the United States, regardless of opposition, adopts any new tariff measures, China will be forced to roll out necessary retaliatory measures.”

On Thursday night, the public comment period on the new U.S. tariffs elapsed in Washington without much dissent, virtually assuring the continuation of a tough punitive approach toward China. While the time frame remains uncertain on the introduction of the new duties, they are expected to hit bicycles, furniture, lighting products, tires, and car seats for babies.

Who will feel the burn?

A farmer in a bin with last season’s soybean crop in Minnesota. American farmers put the brakes on unnecessary spending as the U.S.-China trade war escalates. Jim Mone | AP

The ongoing imposition of duties on Chinese products are likely to hit U.S. consumers, first and foremost, who rely on such cheap goods as a means toward offsetting the effects of stagnant wages, dwindling living standards, and other economic challenges faced by working-poor and middle-class households across the country. Chinese consumers, on the other hand, aren’t expected to face such increases in the costs of goods.

The tariffs would come on top of the previous round of tariffs, which hit $50 billion in Chinese products and sparked the current trade war. China, in turn, has promised to impose its own duties on certain types of aircraft, liquefied natural gas, and other products from the U.S.

Washington has accused China of violating free-trade norms, barring market access for U.S. goods, violating U.S. companies’ intellectual property interests, and providing industrial subsidies while maintaining a $375 billion trade surplus with the U.S.

Any new duties will mark an acute escalation in the fight between the two countries. Yet, while only a small part of China’s broader economy will be limited, the effects of the new round of tariffs will send shockwaves across global supply chains.

Made in China 2025

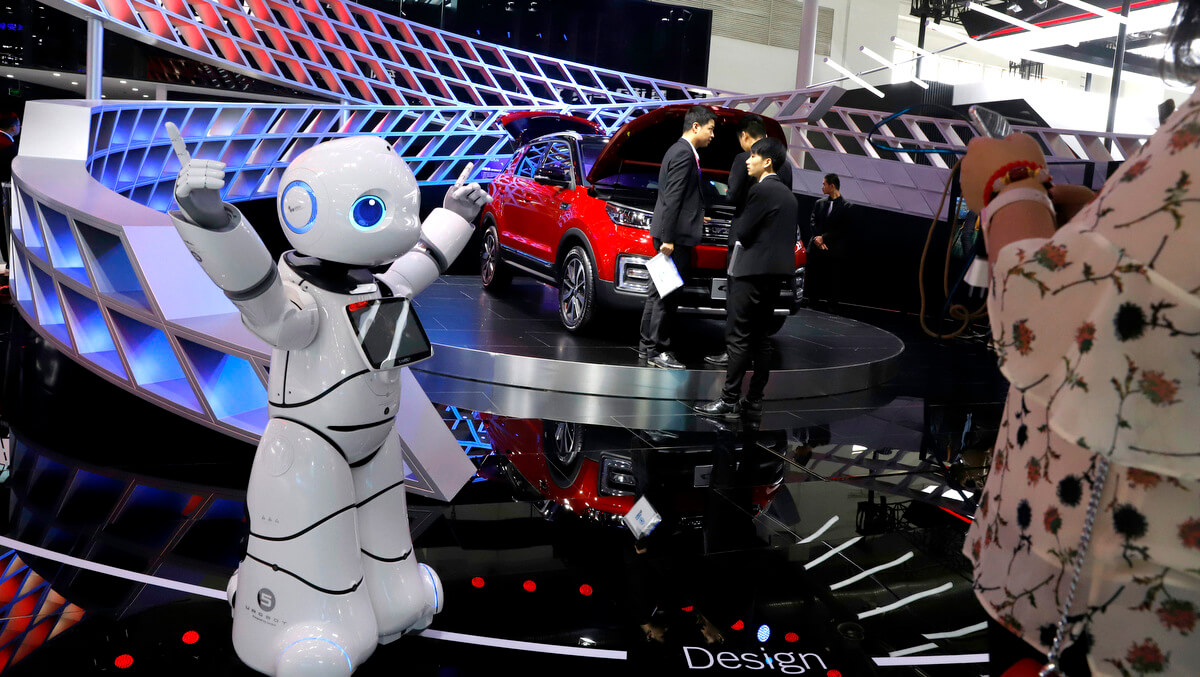

A robot entertains visitors during the China Auto 2018 show in Beijing, China. A program known as “Made in China 2025” aims to make China a tech superpower by advancing development of industries including artificial intelligence, pharmaceuticals and electric vehicles. Ng Han Guan | AP

China itself isn’t without its own economic challenges as a still-developing economic powerhouse that is fully integrated in troubled global markets, where Washington’s attempts to rock the boat can still be keenly felt.

The U.S. is particularly fearful of Beijing’s “Made in China 2025” initiative, which will see the country’s industry upgraded to produce high-tech, value-added goods, enabling the country to take on flagship U.S. firms like Apple and Hewlett-Packard with potentially stiff future competition from such growing companies as Xiaomi, Huawei, and Lenovo.

Global Times, which operates under the auspices of the Communist Party of China’s official People’s Daily newspaper, noted that China would continue to pursue the fundamental transformation and upgrading of China’s manufacturing base toward improved high-tech production.

In an op-ed Thursday, the newspaper noted:

China’s economy is in a critical period in terms of restructuring. Amid escalating trade friction, China has no choice but to pursue a path of independent innovation and overcome the challenges it faces in manufacturing transformation. U.S. protectionist measures won’t hurt China, but will serve as an external catalyst for China’s industrial upgrading that will make the country a manufacturing superpower.”

While Trump has long evangelized a tough and crude anti-China line, accusing Beijing of “raping” the U.S. economy while on the campaign trail, the former reality-TV star is far from alone in his fear that China may eventually become the new economic center of the world. Its rise as the center of high-technology manufacturing would likewise have far-reaching consequences in economic, military, and geopolitical terms.

Whether Washington can forestall its decline as a global hegemonic power and prevent China’s rise in the world system through blunt-force trade measures such as increased tariffs is another question entirely.

One way or another, however, China’s economic rise will require that it wean itself away from its dependence on exporting cheap products and that it instead builds up strong domestic demand while improving its productive base.

Top Photo | An investor checks stock prices at a brokerage house in Beijing, Thursday, Sept. 6, 2018. Asian markets were mixed on fears that the U.S. would soon impose tariffs on another $200 billion of Chinese goods, as public consultations draw to a close. Andy Wong | AP

Elliott Gabriel is a former staff writer for teleSUR English and a MintPress News contributor based in Quito, Ecuador. He has taken extensive part in advocacy and organizing in the pro-labor, migrant justice and police accountability movements of Southern California and the state’s Central Coast.

The post Trump Trade War on China Likely to Roil World Markets While Spurring China’s Development appeared first on MintPress News.