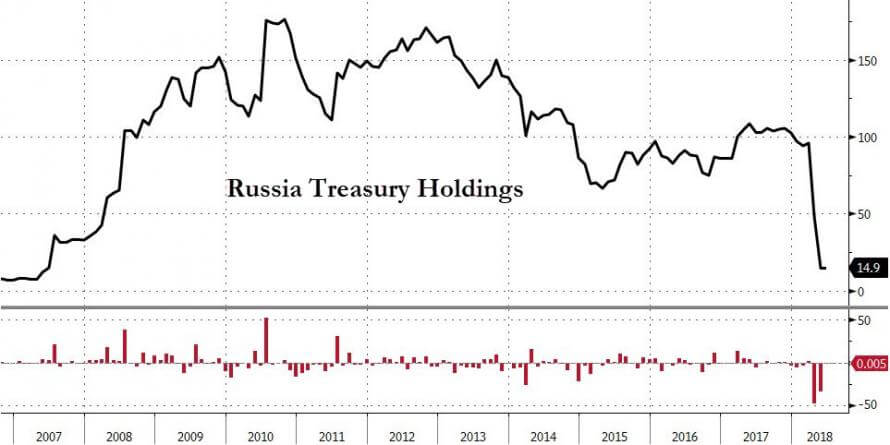

Last month, when we reported that Russia had liquidated the bulk of its US Treasury holdings in just two months, we said that “we can’t help but wonder – as the Yuan-denominated oil futures were launched, trade wars were threatened, and as more sanctions were unleashed on Russia – if this wasn’t a dress-rehearsal, carefully coordinated with Beijing to field test what would happen if/when China also starts to liquidate its own Treasury holdings.”

As it turns out, Russia did lead the way, but not for China.

Instead, another recent US foreign nemesis, Turkey, was set to follow in Putin’s footsteps of “diversifying away from the dollar”, and in the June Treasury International Capital, Turkey completely dropped off the list of major holders of US Treasurys, which has a $30 billion floor to be classified as a “major holder.”

According to the US Treasury, Turkey’s holdings of bonds, bills and notes tumbled by 52% since the end of 2017, dropping to $28.8 billion in June from $32.6 billion in May and $61.2 billion at the recent high of November of 2016.

Meanwhile, as we showed earlier, Russia – which first fell off the list last month after being a top-10 foreign creditor to the US just a few years ago – saw its Treasury holdings remain unchanged at an 11 year low of just $14.9 billion.

The selloffs took place well before a diplomatic fallout between the US and both Turkey and Russia resulted in new sets of sanctions and tariffs imposed on both nations. The Trump administration last week imposed new sanctions against Russia in response to the nerve agent poisoning in the U.K. of a former Russian spy and his daughter.

The Turkish selloff certainly continued into July and August as U.S. relations with Turkey deteriorated this week after President Trump doubled steel and aluminum tariffs to pressure the nation to release a jailed American pastor. Turkey increased the tensions by announcing new tariffs on American products such as cars as President Recep Tayyip Erdogan called for a boycott of iPhones and other U.S. electronics.

And with the anti-US axis started to solidify, with first Russia now Turkey dumping US paper, the question once again is: when, and under what conditions, would China – or others – join the all too symbolic step of selling of US government debt?

Top Photo | A worker at a currency exchange shop worker lays out Turkish lira banknotes depicting modern Turkey’s founder Mustafa Kemal Ataturk, in Istanbul, Aug. 15, 2018. Lefteris Pitarakis | AP

Source | ZeroHedge

The post More Fallout from Trump’s Economic War as Turkey Joins Russia In Liquidating US Treasuries appeared first on MintPress News.