In the name of the fight against terrorism, the United States is currently waging “credit-card wars” in Afghanistan, Iraq, Syria, and elsewhere. Never before has this country relied so heavily on deficit spending to pay for its conflicts. The consequences are expected to be ruinous for the long-term fiscal health of the U.S., but they go far beyond the economic. Massive levels of war-related debt will have lasting repercussions of all sorts. One potentially devastating effect, a new study finds, will be more societal inequality.

In other words, the staggering costs of the longest war in American history — almost 17 years running, since the invasion of Afghanistan in October 2001 — are being deferred to the future. In the process, the government is contributing to this country’s skyrocketing income inequality.

Since 9/11, the U.S. has spent $5.6 trillion on its war on terror, according to the Costs of War Project, which I co-direct, at Brown University’s Watson Institute for International and Public Affairs. This is a far higher number than the Pentagon’s $1.5 trillion estimate, which only counts expenses for what are known as “overseas contingency operations,” or OCO — that is, a pot of supplemental money, outside the regular annual budget, dedicated to funding wartime operations. The $5.6 trillion figure, on the other hand, includes not just what the U.S. has spent on overseas military operations in Iraq, Afghanistan, Pakistan, and Syria, but also portions of Homeland Security spending related to counterterrorism on American soil, and future obligations to care for wounded or traumatized post-9/11 military veterans. The financial burden of the post-9/11 wars across the Greater Middle East — and still spreading, through Africa and other regions — is far larger than most Americans recognize.

During prior wars, the U.S. adjusted its budget accordingly by, among other options, raising taxes to pay for its conflicts. Not so since 2001, when President George W. Bush launched the “Global War on Terror.” Instead, the country has accumulated a staggering amount of debt. Even if Washington stopped spending on its wars tomorrow, it will still, thanks to those conflicts, owe more than $8 trillion in interest alone by the 2050s.

Putting the Gilded Age to Shame

U.S. Army M2A2 and M2A3 Bradley fighting vehicles are unloaded at a pier in Busan, South Korea, June 29, 2011.Yonhap, Kim Sun-ho | AP

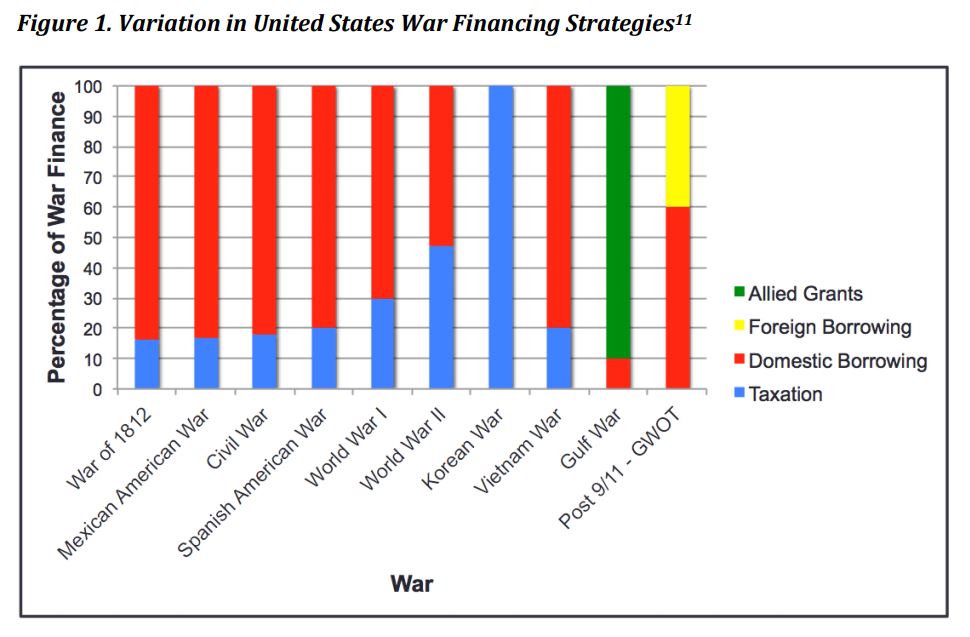

It’s hard to fathom what that enormous level of debt will do to our economy and society. A new Costs of War study by political scientist and historian Rosella Capella Zielinski offers initial clues about its impact here. She takes a look at how the U.S. has paid for its conflicts from the War of 1812 through the two World Wars and Vietnam to the present war on terror. While a range of taxes, bond sales, and other mechanisms were used to raise funds to fight such conflicts, no financial strategy has relied so exclusively on borrowing — until this century. Her study also explores how each type of war financing has affected inequality levels in this country in the aftermath of those conflicts.

The implications for today are almost painfully straightforward: the current combination of deficit spending and tax cuts spells disaster for any hopes of shrinking America’s striking inequality gap. Instead, credit-card war spending is already fueling the dramatic levels of wealth inequality that have led some observers to suggest that we are living in a new Gilded Age, reminiscent of the enormous divide between the opulent lifestyles of the elite and the grinding poverty of the majority of Americans in the late nineteenth century.

Capella Zielinski carefully breaks down what effects the methods used to pay for various wars have had on subsequent levels of social inequality. During the Civil War, for example, the government relied primarily on loans from private donors. After that war was over, the American people had to pay those loans back with interest, which proved a bonanza for financial elites, primarily in the North. Those wealthy lenders became wealthier still and everyone else, whose taxes reimbursed them, poorer.

Source: Boston University | Cost of War project

In contrast, during World War I, the government launched a war-bond campaign that targeted low-income people. War savings stamps were offered for as little as 25 cents and war savings certificates in denominations starting at $25. Anyone who could make a small down payment could buy a war bond for $50 and cover the rest of what was owed in installments. In this way, the war effort promoted savings and, in its wake, a striking number of low-income Americans were repaid with interest, decreasing the inequality levels of that era.

Taxation strategies have varied quite significantly in various war periods as well. During World War II, for instance, the government raised tax rates five times between 1940 and 1944, levying progressively steeper ones on higher income brackets (up to 65% on incomes over $1 million). As a result, though government debt was substantial in the aftermath of a global struggle fought on many fronts, the impact on low-income Americans could have been far worse. In contrast, the Vietnam War era began with a tax cut and, in the aftermath of that disastrous conflict, the U.S. had to deal with unprecedented levels of inflation. Low-income households bore the brunt of those higher costs, leading to greater inequality.

Today’s wars are paid for almost entirely through loans — 60% from wealthy individuals and governmental agencies like the Federal Reserve, 40% from foreign lenders. Meanwhile, in October 2001, when Washington launched the war on terror, the government also initiated a set of tax cuts, a trend that has only continued. The war-financing strategies that President George W. Bush began have flowed on without significant alteration under Presidents Obama and Trump. (Obama did raise a few taxes, but didn’t fundamentally alter the swing towards tax cuts.) President Trump’s extreme tax “reform” package, which passed Congress in December 2017 — a gift-wrapped dream for the 1% — only enlarged those cuts.

In other words, in this century, Washington has combined the domestic borrowing patterns of the Civil War with the tax cuts of the Vietnam era. That means one predictable thing: a rise in inequality in a country in which the income inequality gap is already heading for record territory.

Just to add to the future burden of it all, this is the first time government wartime borrowing has relied so heavily on foreign debt. Though there is no way of knowing how this will affect inequality here in the long run, one thing is already obvious: it will transfer wealth outside the country.

Economist Linda Bilmes has argued that there’s another new factor involved in Washington’s budgeting of today’s wars. In every other major American conflict, after an initial period, war expenditures were incorporated into the regular defense budget. Since 2001, however, the war on terror has been funded mainly by supplemental appropriations (those Overseas Contingency Operations funds), subject to very little oversight. Think of the OCO as a slush fund that insures one thing: the true impact of this era’s war funding won’t hit until far later since such appropriations are exempt from spending caps and don’t have to be offset elsewhere in the budget.

According to Bilmes, “This process is less transparent, less accountable, and has rendered the cost of the wars far less visible.” As a measure of the invisible impact of war funding in Washington and elsewhere, she calculates that, while the Senate Appropriations Subcommittee on Defense discussed war financing in 79% of its hearings during the Vietnam era, since 9/11, there have been similar mentions at only 17% of such hearings. For its part, the Senate Finance Committee has discussed war-funding strategy in a thoroughgoing way only once in almost 17 years.

Hidden Tradeoffs and Deferred Costs

Homeless tents are dwarfed by skyscrapers in Los Angeles. Jae C. Hong | AP

The effect of this century’s unprecedented budgetary measures is that, for the most part, the American people don’t feel the financial weight of the wars their government is waging — or rather, they feel it, but don’t recognize it for what it is. This corresponds remarkably well with the wars themselves, fought by a non-draft military in distant lands and largely ignored in this country (at least since the vast public demonstrations against the coming invasion of Iraq ended in the spring of 2003). The blowback from those wars, the way they are coming home, has also been ignored, financially and otherwise.

However little the public may realize it, Americans are already feeling the costs of their post-9/11 wars. Those have, after all, massively increased the Pentagon’s base budget and the moneys that go into the expanding national security budget, while reducing the amount of money left over for so much else from infrastructure investment to science. In the decade following September 11, 2001, military spending increased by 50%, while spending on every other government program increased only 13.5%.

How exactly does this trade-off work? The National Priorities Project explains it well. Every year the federal government negotiates levels of discretionary spending (as distinct from mandatory spending, which largely consists of Social Security and Medicare). In 2001, there were fewer discretionary funds allocated to defense than to non-defense programs, but the ensuing war on terror dramatically inflated military spending relative to other parts of the budget. In 2017, military and national security spending accounted for 53% of discretionary spending. The 2018 congressionally approved omnibus spending package allocates $700 billion for the military and $591 billion for non-military purposes, leaving that proportion about the same. (Keep in mind, that those totals don’t even include all the money flowing into that Overseas Contingency Operations fund). President Trump’s proposals for future spending, if accepted by Congress, would ensure that, by 2023, the proportion of military spending would soar to 65%.

In other words, the rise in war-related military expenditures entails losses for other areas of federal funding. Pick your issue: crumbling bridges, racial justice, housing, healthcare, education, climate change — and it’s all being affected by how much this country spends on war.

Nonetheless, thanks to its credit-card version of war financing, the government has effectively deferred most of the financial costs of its unending conflicts to the future. This, in turn, contributes to how detached most Americans tend to feel from the very fact that their country is now eternally at war. Political scientist and policy analyst Sarah Kreps argues that Americans become invested in how a war is being conducted only when they’re asked to pay for it. In her examination of the history of the financing of American wars, she writes, “The visibility and intrusiveness of taxes are exactly what make individuals scrutinize the service for which the resources are being used.” If there were war taxes today, their unpopularity would undoubtedly lead Americans to question the costs and consequences of their country’s wars in ways now missing from today’s public conversation.

Pressing for a real war budget, though, is not only a mechanism to alert Americans to the effects (on them) of the wars their government is fighting. It is also a potential lever through which citizens could affect the country’s foreign policy and pressure elected officials to bring those wars to an end. Some civic groups and activists from across the political spectrum have indeed been pushing to reduce the Pentagon budget, bloated by war, corruption, and fear-mongering. They are, however, up against both the power of an ascendant military-industrial complex and wars that have been organized, in their funding and in so many other ways, not to be noticed.

Those who care about this country’s economic future would be remiss not to include today’s war financing strategy among the country’s most urgent fiscal challenges. Anyone interested in improving American democracy and the well-being of its people should begin by connecting the budgetary dots. The more money this country spends on military activities, the more public coffers will be depleted by war-related interest payments and the less public funding there will be for anything else. In short, it’s time for Americans worried about living in a country whose inequality gap could soon surpass that of the Gilded Age to begin paying real attention to our “credit-card wars.”

Top Photo | Homeless Korean War veteran Thomas Moore, 79, left, speaks with Boston Health Care for the Homeless street team outreach coordinator Romeena Lee on a sidewalk in Boston. Steven Senne | AP

Stephanie Savell is co-director of the Costs of War Project at Brown University’s Watson Institute for International and Public Affairs. An anthropologist, she has conducted research on security and civic engagement in the U.S. and in Brazil. She co-authored The Civic Imagination: Making a Difference in American Political Life.

Source | Tom’s Dispatch

The post How America’s Wars Abroad are Funding Inequality at Home appeared first on MintPress News.